The problem is that no one can, with any reasonable degree of certainty, prescribe policy responses that will lead us out of this mess. In fact, there is no magic macroeconomic policy prescription - fiscal, monetary, financial, or behavioural - that can restore normalcy in the financial markets and the economy. The only hope is to swiftly throw every policy response possible and that too in massive quantities, and then hope something or the other works.

Everything the US and others have tried till now - zero-bound monetary policy, quantitative easing, direct cash-infusions, fiscal stimulus etc - were tried by Japan in the past two decades, and in massive size. The Bush and now Obama administrations, and governments elsewhere, are implementing these policies with the same prevarication as the Japanese, understandable given the uncertainty surrounding their success and apprehensions about the popular backlash at the prospect of bailing out greedy bankers and investors. And like the Japanese in the nineties, the present day governments too are wary of the final plunge by taking direct equity positions or allowing banks to fail, leave alone extreme steps like "nationalization", to rein in the downward spiral.

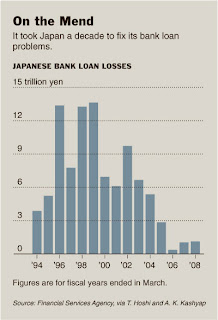

It took Japan nearly two decades to emerge from its version of banking crisis induced economic recession - a real estate bubble burst in early nineties, leaving banks holding trillions of yen in loans that were virtually worthless, forcing a credit squeeze and economic recession. All of the proposals contemplated in the FSP announced by Treasury Secretary Tim Geithner, including leveraging private capital to create a market in distressed assets, were tried out, to little effect. From 1992 to 2005, Japanese banks wrote off about 96 trillion yen, or about 19% of the GDP. Real estate prices fell for 15 years in a row, equity markets declined by three-quarters, and the nation was trapped in a liquidity trap induced deflationary recession.

After meandering for nearly a decade with half-hearted equity injections and fiscal pum-priming, the financial markets started stabilizing from 2002, immediately in the aftermath of implementation of a massive and rigorous audit of the country’s top banks under the Takenaka Plan (Heizo Takenaka headed the government’s financial reform efforts), a move that forced out the full extent of bad loans to light. They also nationalized a major bank and allowed a few to fail. To that extent Geithner's stress tests are a step in the right direction.

Many economists like Paul Krugman have warned that we may be in for a long, long haul, and are looking at a Great Depression 2.0! Describing it a "balance sheet recession", Axel Leijonhufvud too feels that this recession is different from the regular troughs, and that "fiscal stimulus will not have much effect as long as the financial system is deleveraging".

He writes, "The financial crisis has put much of the banking system on the edge – or beyond - of insolvency. Large segments of the business sector are saddled with much short-term debt that is difficult or impossible to roll over in the current market. After years of near zero saving, American households are heavily indebted... the private sector as a whole is bent on reducing debt. Businesses will use depreciation charges and sell off inventories to do so. Households are trying once more to save. Less investment and more saving spell declining incomes. The cash flows supporting the servicing of debts are dwindling. The efforts by financial firms to deleverage... can trigger a rapid avalanche of defaults".

He also refers to a twin dilemma, "If government programs end up not being large enough to turn the recession around, we have to look forward to a deflationary period of indeterminate length. If they do succeed, however, severe inflationary pressures may surface quite quickly."

Nouriel Roubini paints the entire American banking system as "insolvent" and estimates that they need $1.4 trillion in new cash to return their capital levels to where they were before the crisis began, and this can be delivered effectively only by way of nationlization. He estimates that total losses on loans by American financial firms and the fall in the market value of the assets they hold will reach $3.6 trillion, up from his previous estimate of $2 trillion, of which banks will account for $1.7-1.8 trillion, the economy will contract from its peak by 5%, unemployment will touch 9% and real estate will fall another 20%.

Many other prominent opinion makers too feel that the Geithner plan is too little too late, and will only prolong the misery and increase the final costs. Without cleaning up the bad assets from the balance sheets of banks, it will not be possible to get banks restore their normal lending operations. There are increasing number of voices who now say that, like in Japan in 2002, Sweden in 1992 and the US itself in 1987-89, the government needs to aggressively intervene to weed out the weakest banks (translation - let them fail), pour capital into the surviving banks (translation - nationalize) and sell off their bad assets. And all this will need much more than the $350 bn left over under FSP, and could go well beyond another $ 1 trillion.

The experience of the Savings and Loan (S&L) crisis shows that a large number of banks failed and their assets were taken over and liquidated over a few years by the Resolution Trust Corporation (RTC). As the figure below shows, this time we are yet to reach those levels of failures. But if the S&L crisis is an indicator, as it looks increasingly likely, then the FDIC, which is responsible for taking over and liquidating the failing banks, may have to follow the example of the RTC.

Update 1

NYT has this article on how consumer spending has fallen in Japan, depriving the emabttled economy off one of its most important domestic engines for economic growth. As companies have cut costs, in order to bolster bottomlines, wages have been compressed and one-third of the labour force in the country have become temporary or non-traditional with no job security and fewer benefits.

Update 2

The Economist has this wrap up and an excellent graphic of how different countries have unleashed their fiscal fire-power. Dani Rodrik sums up the global fiscal stimulus plans here. An Excel sheet on the stimulus plans here.

Update 3

NYT has this article that examines three indicators - stock prices, home values, and consumer spending - as to whether the markets have bottomed out and recovery is on its way.

Update 4

The Economist has this report on the build-up to the London summit.

No comments:

Post a Comment