1. Establish a single entity with responsibility for systemic stability (a systemic risk regulator) over the major institutions and critical payment and settlement systems and activities.

2. Establish and enforce substantially more conservative capital requirements for institutions that pose potential risk to the stability of the financial system, that are designed to dampen rather than amplify financial cycles.

3. Requirement that leveraged private investment funds (hedge funds and private equity funds), with assets under management over a certain threshold, register with the SEC to provide greater capacity for protecting investors and market integrity.

4. Establish a comprehensive framework of oversight, protections and disclosure for the OTC derivatives market, moving the standardized parts of those markets to central clearinghouse, and encouraging further use of exchange-traded instruments (bringing instruments like CDS under regulatory oversight).

5. SEC should develop strong requirements for money market funds to reduce the risk of rapid withdrawals of funds that could pose greater risks to market functioning.

6. Establish a stronger resolution mechanism that gives the government tools to protect the financial system and the broader economy from the potential failure of large complex financial institutions. This would involve setting up a resolution regime that provides authority to avoid the disorderly liquidation of any non-bank financial firm whose disorderly liquidation would have serious adverse effects on the financial system or the US economy.

Announcing that the days of "light-touch regulation are over", Geithner also called for the government to more actively regulate executive compensation, not just at companies that are receiving federal bailout money, but at all companies that might be providing incentives for excessive risk-taking.

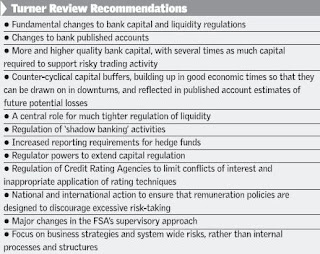

Meanwhile across the Atlantic, in the UK, the British Government commissioned Lord Adair Turner, Chairman of the Financial Services Authority (FSA), to do a review and submit proposals for more effective regulation of the financial markets. The Businessline has an excellent summary of its recommendations in the graphic below

The Turner Review (and its comprehensive discussion paper here) of financial regulation is the most comprehensive blueprint and starting point for any discussion on financial market regulation. In contrast to what people like Dani Rodrik have argued for, Turner says that purely national and piecemeal regulation is "by far second best", and calls for "internationally agreed" and systemic regulation. The Turner review identifies three proximate causes for the problems - global macroeconomic imbalances, inadequate bank capital and the need for better liquidity regulation, and financial innovation of little social value.

Questioning the "theory of rational and self-correcting markets", he points to the dichotomy in financial regulation between the US and the rest of the world, manifested in the debate between 'principles-based regulation’ and ‘rules-based regulation’. As Businessline writes, "The former held that all that is needed for an efficient financial sector is an enunciation by the empowered authority of the principles that are needed in the sector, and that if these were observed, heaven would be at hand... most of the rest of the world held that principles were all very well, but how would you ensure that they were observed if there were no rules?"

The Turner recommendations include banks to have higher quantity and quality of capital-asset ratios - even higher than Basel II ones; fundamental review of risk management models and practices; counter-cyclical capital buffers to be built up in good times, so that they can be drawn on in downturns, and reflected in published account estimates of future potential losses; a resolution regime which facilitates the orderly wind down of failed banks should be in place; a central role for much tighter regulation of liquidity; limits on leverage ratios; new capital and liquidity requirements to be designed to constrain commercial banks’ role in risky proprietary trading activities; greater reporting and diclosure requirements; greater coverage of deposit insurance; stricter supervision of rating agencies and more transparent information disclosure; netting, clearing and central counterparty in derivatives trading; greater regulation of executive compensation to to avoid incentives for undue risk taking; trans-national body for supervision of cross-border banks; offshore financial centres to be covered by global agreements on regulatory standards; collaborative macro-prudential analysis and the identification of policy measures by national and global regulatory institutions etc. It also calls for the establishment and effective operation of colleges of supervisors for the largest complex and cross-border financial institutions, and pre-emptive development of crisis coordination mechanisms and contingency plans between supervisors, central banks and finance ministries.

Chris Dillow raises some important concerns with the Turner recommendations.

Update 1

Thomas Palley has an excellent article in favor of asset based reserve requirements (ABRR) as the favored means of dfinancial market regulation.

No comments:

Post a Comment