In one of the most ambitious and far-reaching efforts at reforming the health care system, the Obama administration, through the Senate Committee on Health, Education, Labor, and Pensions (HELP), early last month, released the draft (trial balloon bill) Affordable Health Choices Act (see summary here). Under the proposed reforms, the federal government would provide grants to states to establish insurance exchanges (called "gateways") through which individuals and families could purchase coverage from various service providers. It is also proposed that the federal government would subsidize the purchase of health insurance through those exchanges for individuals and families with income between 150-500% of the federal poverty level (FPL), so as to substantially reduce the cost of that coverage for some enrollees.

Individuals with income below 150% of the FPL would be exempt and the payment would be waived in certain other cases. Those subsidies would represent the greatest single component of the proposal’s cost and is estimated to be in the range of nearly $1.3 trillion in the 2010-19 period. Individuals with an offer of employer-sponsored insurance would not be eligible for exchange subsidies under the proposal.

Insurers issuing new health insurance policies sold in the individual and group insurance markets would be required to issue coverage to all applicants (and not limit coverage for pre-existing medical conditions), and premiums for a given plan could not vary because of enrollees’ health and could vary by their age to only a limited degree (under a system known as adjusted community rating).

Controversially, the proposal does not include a "public plan option" that would be offered in the exchanges, nor does it contain provisions that would require employers to offer health insurance benefits or impose a fee or tax on them if they did not offer insurance coverage to their workers. A public plan, offered by non-profits or the government, would be available as a default option for citizens and compete with private plans for offering insurance policies. It would be similar to conventional Medicare (the "public Medicare plan", as distinguished from private plans that contract with Medicare) in that it would be managed by the federal government and pay private providers to deliver care.

In its analysis of this Obama health care reform proposal, the CBO has estimated a net increase in federal budget deficits of about $1.0 trillion over the 2010–2019 period. Once fully implemented, about 39 million individuals would obtain coverage through the new insurance exchanges, the number of people who had coverage through an employer would decline by about 15 million (or roughly 10%), and coverage from other sources would fall by about 8 million, thereby creating a net decrease in the number of people uninsured would be about 16 million.

Critics of the draft plan argue that the most fundamental problem with the existing health insurance system - inflated costs - will remain un-addressed without a government run "public plan option". As Robert Reich writes, "Without a public option, the other parties that comprise America's non-system of health care - private insurers, doctors, hospitals, drug companies, and medical suppliers - have little or no incentive to supply high-quality care at a lower cost than they do now".

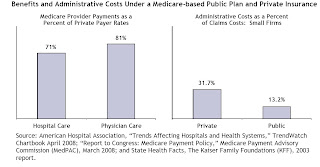

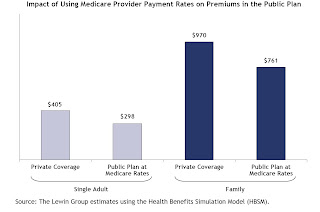

They also claim that the "public plan" would offer much needed competition, incentivize saving of money through low administrative costs and optimal profits, and put downward pressure on the prices of medical services and technology. It would act as a benchmark for comparing between the costs and outcomes of competing private plans, and also effectively become an insurer of last resort. In other words, it would "nudge" the private insurers to become more cost-effective and deliver "better health care for less". The individuals and families can use the subsidies to shop for the best plan - public or private - they can find and the subsidies will go to individuals and families who need them in order to afford health care, not to a public plan. President Obama himself summed up the benefits of public option by claiming that ti would give Americans "a better range of choices, make the health care market more competitive, and keep the insurance companies honest".

In a cost and coverage implications of a public plan, the Lewin Group has found considerable scope for increases in coverage (and hence expand the revenue base for providers of health care) and lowering of costs in comparison to private plans.

However, all the major stakeholders, excluding the patients, and including the American Medical Association, are fiercely opposed to a "public option" and see it as a Trojan horse for a government takeover of all of health insurance. The Republicans acciordingly denounce it as "socialized medicine". They say that a single (for the country) "public option" would have unfair advantages - large economies of scale that will enable it to negotiate more favorable terms with pharmaceutical companies and other providers, it would contain implicit or covert subsidies from the government, and that public plans would not have to strive for profits. There are others who argue that the curtailment in profits that come with any "public option" would do more long term harm than good by reducing the R&D budgets of the pharamaceutical companies.

Robert Reich has answered the critics here and here. And Paul Krugman here and here, and feels that President Obama's urge to compromise and gather bi-partisan support may end up making health care reforms a non-starter. Mark Thoma makes a brilliant case for the public option here.

Krugman feels that "insurers mainly compete by engaging in 'risk selection' — that is, the most successful companies are those that do the best job of denying coverage to those who need it most". Ezra Klein on the press misrepresenting the health care reforms debate. Uwe Reinhart de-mystifies some of the frightening numbers that opponents of reforms use to scare public opinion.

Greg Mankiw raises questions about the public option here and here. George Will questions the health care reform proposals on fiscal grounds. And a debate between John Taylor and Paul Krugman is available here.

---------------------------

More on the health care reform debate is available here, and more on America's health care system is available here. Uwe Reinhart has this Medicare based hospital pricing model, which makes payment for the entire inpatient episode, rather than piece-rate (fee-for-service) for every single supply and service delivered in that episode adopted by private insurers.

Europe and Canada have universal health care systems where all individuals are insured for a basic package of health care benefits; the individual’s contribution to the financing of health care is closely tied to the his ability to pay; premiums for children are covered by government out of general revenues, on the premise that they are national treasures whose health care should be the entire nation’s fiscal responsibility. The statutory health insurance is financed by an income-based payroll tax, with contribution from employers. Unemployment insurance pays the premiums for unemployed individuals, and pension funds share with the elderly in financing their premiums, which are set below actuarial costs for the elderly.

In Germany, the health insurance premiums paid by Germans are collected in a national, government-run central fund that effectively performs the risk-pooling function for the entire system. This fund redistributes the collected premiums to some 200 independent, nongovernmental, competing, nonprofit "sickness funds" among which Germans can choose based on the individual's actuarial risk. These funds act as purchasing agents on behalf of the central fund and patients by purchasing medical services from doctors, hospitals, drug companies, etc. It is similar in Netherlands and Switzerland.

Update 1

The Economist explores the reasons for the high cost of health care in the US.

Update 2

Uwe Reinhart makes the case that the critics of health care reforms are mistaken in their understanding of "rationing" of health care. These critics have been arguing that by refusing to pay for procedures that the managers of these insurance pools do not consider worth the taxpayer’s money, government insurance programs deny the full health coverage for the insured. On the contrary, Reinhart argues that the purpose of health care reform is to reduce rationing on the basis of price and ability to pay in America's health system and to seek greater value for the dollar in health care, through comparative effectiveness analysis and payment reform.

Mark Thoma has much the same to say on the gorunds of equity - "access to life-saving and life-improving technology and treatments should not depend upon having sufficient household income". Bruce Bartlett weighs in here.

Ezra Klein makes the case against a single-payer system here.

Update 1

David Leonhart cites the case of treatment for prostate cancer to illustrate how expensive therapies are becoming the most commonly prescribed solutions despite no indications of their superiority. Floyd Norris elaborates further.

Update 2

Cancer treatment offers another excellent example of the problems with pricing health care and the consequent need to have incentives in place that optimizes treatment subject to budget constraints.

David Leonhardt has this to say in the Times,

"Men with the most common form — slow-growing, early-stage prostate cancer — can choose from at least five different courses of treatment. The simplest is known as watchful waiting, which means doing nothing unless later tests show the cancer is worsening. More aggressive options include removing the prostate gland or receiving one of several forms of radiation. The latest treatment — proton radiation therapy — involves a proton accelerator that can be as big as a football field.

Some doctors swear by one treatment, others by another. But no one really knows which is best. Rigorous research has been scant. Above all, no serious study has found that the high-technology treatments do better at keeping men healthy and alive. Most die of something else before prostate cancer becomes a problem. No therapy has been shown superior to another... We’re not sure how good any of these treatments are... the treatments have roughly similar benefits, they have very different prices...

And in our current fee-for-service medical system — in which doctors and hospitals are paid for how much care they provide, rather than how well they care for their patients — you can probably guess which treatments are becoming more popular: the ones that cost a lot of money. Use of I.M.R.T. rose tenfold from 2002 to 2006, according to unpublished RAND data... The country is paying at least several billion more dollars for prostate treatment than is medically justified — and the bill is rising rapidly."

Update 3

Jonathan Gruber proposes closing the loophole that permits tax exclusion from employer sponsored health insurance in the US (the employers contribution to health insurance plan is not taxed). He writes, "We might consider merely capping the dollar amount of employer-sponsored health insurance that is excluded from income taxation. Individuals would include in their income taxes the amount of premiums over and above, say, the average cost of employer-sponsored insurance... This policy would provide strong incentives to purchase insurance more efficiently, since the highest-cost plans would be taxed but lower-cost plans would not. To ensure that the cap was not unfair to employees with relatively high insurance costs, employers could be allowed to compute an adjustment in the cap based on their location or their workers’ ages."

As David Leonhardt says, this taxation would dis-incentivize greater spending on health insurance and encourage employees and employers to prefer more cost-effective policies. Besides, it would also raise much needed revenues to fund the ballooning health care deficits. He writes, "Because health care — unlike food, clothing and most other things — isn’t taxed, it’s effectively on sale. And when something is on sale, people often buy more of it than they need. In the case of health care, they buy — or their employer buys for them — insurance plans that don’t make much of an effort to control costs. Rather than putting pressure on hospitals to root out administrative waste, the plans cover the cost of that waste. They also cover the costs of brand-name drugs that are no more effective than generic alternatives and other kinds of expensive care that do little to improve health."

Update 4

And Robert Reich makes an impassioned case for a Medicare like public option plan to make private insurers competitive.

Update 5

Paul Krugman makes the case why the public option is necessary. Also Ezra Klein and Mark Thoma.

No comments:

Post a Comment