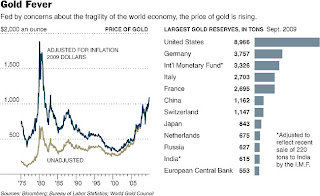

Gold has gained more than 25% in 2009, driven by persistent weakness in the US dollar and the uncertainty surrounding the economic prospects of US and other advanced economies. It touched $1104 an ounce or adjusted for inflation an all time high of $1,885 per ounce (or Rs 16,900 per 10 gram in the Indian bullion market) a few days back and looks set to rise further.

However, though gold is a secure asset but historical statistics show that, excluding its speculative side, it yields a low, long-term rate of returns from collateral fees. An investment of Rs 10,000 in gold in 1981 would would have grown to just Rs 35,832 over 20 years to 2002, a return of 6.3 per cent per annum, whereas similar investments in BSE Sensex would be worth Rs 240,062, outperforming gold by over 10 percentage points. A similar investment in even one-year bank fixed deposits over the same period would be worth Rs 82,350 by 2002, an annual growth rate of 10.6%, outperforming gold by 2.3 times. The graphic below compares the performance of gold for different periods from 2008 down

The price of gold over a broad sweep of history (1344-1998) shows this trend in gold prices

Gold prices have been on an upward trend in since 2002...

Gold has always been a safe haven in uncertain times and when the economy is on a decline, with investors scrambling to its safety and liquidity during such times, thereby driving up gold prices. This has given gold business a recession-proof character. Further, its proven negative correlation with the US dollar makes it a good option for investors wishing to diversify their portfolio from the currency. This current increase in gold prices is a consequence of the uncertainty surrounding the global financial markets in the wake of the bursting of the sub-prime mortgage bubble and the ongoing economic recession.

Further, global gold reserves are too limited in quantity (less than $1 trillion in value) to be a meaningful source of parking forex reserves. In addition, its liquidity is poor, it pays no interest and the cost of storage is high. In addition to the aforementioned, the high prevailing market prices will also be a deterrent to Central Banks purchasing gold in large quantities. In the circumstances, the RBI's decision to purchase gold at around $1045 an ounce is atleast four years too late ($500 to an ounce in 2005) and has to be seen as an example of buying high, and only history will show whether it was a wise decision.

Update 1

William Buiter writes that gold is a fiat commodity and cannot be compared to other similar assets - shares, real estate etc - as an investment nor to paper money as a store of value given the large cost associated with producing it.

Update 2

This graphic form the FE explains gold price movements over the last four decades

See also the FE articles here, here and here.

Update 3

Nouriel Roubini explains why gold prices are rising and why it may not be sustainable - "Gold prices rise sharply only in two situations: when inflation is high and rising, gold becomes a hedge against inflation; and when there is a risk of a near depression and investors fear for the security of their bank deposits, gold becomes a safe haven".

Update 4

Chris Dillow points to a negative co-relation between gold prices and inflation - "global inflation rises, the world’s central bankers could reverse their slack monetary policies, causing gold to fall".

Update 5

Martin Feldstein doubts the utility of gold as a hedge - "The dollar price of gold does not increase with the US price level. And the value of gold does not increase in dollars to offset the fall in the value of the dollar relative to the euro or the yen."

No comments:

Post a Comment