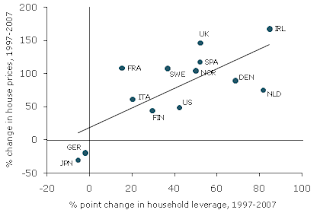

It now appears that America was not alone in travelling this path. A San Fracisco Fed working paper by Reuven Glick and Kevin J. Lansing finds clear evidence of both home price bubbles and excessively leveraged households across many developed economies in the 1997-2007 period.

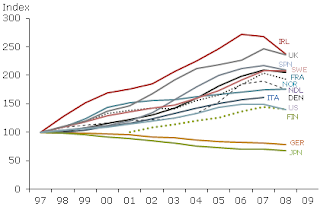

Real house prices have been on the way up since 1997

(All series are indexed to 100 in 1997 except Finland, which is indexed to 100 at 2001)

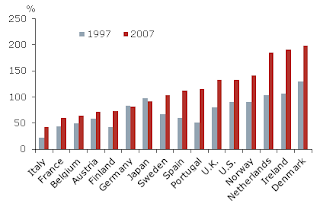

Household leverage ratios or share of debt to disposable incomes have followed suit, with Denmark and Ireland leading the way

The correlation between home prices and leverage is unmistakable

And those with the largest increases in household levereage have experienced the biggest declines in household consumption as the process of deleveraging started in the aftermath of the bubble bursting

1 comment:

Hi. I agree that housing bubbles appeared worldwide, not only in the US. However, I must say I am a bit horryfied by the economical development in China and the way the US and Chinese economies are connected. In my opinion, China is creating another enormous housing bubble which will, sooner or later, burst. The problem is that this will influence the American and, consequently, worldwide economy, too.

Take care,

Jay

Post a Comment