This discussion paper comes even as Britain faces the twin problems of meeting an estimated $317 billion price tag for energy investment to both replace old infrastructure and meet growing needs, and doing so while respecting the European Union’s target of sourcing 20% of energy from renewable sources by 2020.

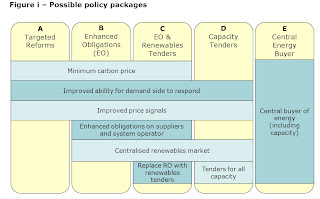

It draws attention to the difficult financial conditions in the medium term, fuel sourcing risks in the medium and long-term, distorted short-term price signals at times of system stress that do not fully reflect the value that customers place on supply security, and the uncertainty in future carbon prices that is likely to delay or deter investment in low carbon technology and lead to greater decarbonisation costs in the future. It proposes five possible policy ‘packages’, starting with those involving the least reform and intervention in the market on the left and moving to the most dramatic move away from competitive markets on the right.

About the five proposed packages, it writes

"A minimum carbon price, which would provide long term certainty for investors and should bring forward low carbon investment, features in three of the packages. Improved price signals coupled with measures to promote demand side response, should improve security of supply by increasing the incentives to make peak energy supplies available and invest in peaking capacity including storage. In two of the packages, we include enhanced obligations on industry players to deliver a specific level of supply security. In some packages, we include the concept of a centralised renewables market designed to help manage the variability of some forms of renewable energy sources for both the generator and the system operator. Long term capacity tenders covering renewables, low carbon generation and/or gas storage feature in some packages to facilitate financing, and in one case these are coupled with short term capacity tenders for all generation and demand side response. The Central Energy Buyer package envisages a single entity responsible for coordinating the procurement of new energy supplies, or at least certain forms of energy supplies or infrastructure such as strategic gas storage."

And its assessments of the five packages

"Those that target specific volumes and types of investment, such as the Central Energy Buyer and Capacity Tenders, would in theory be expected to increase the probability of delivering security of supply and environmental objectives. However, there are risks associated with leaving a central entity to make all the key decisions, which could turn out to be wrong. There is also a risk that large scale, centralised supply side solutions will dominate at the expense of small scale, local solutions and demand side response. These packages are also likely to be more difficult and time consuming to implement, and importantly there may be significant legal issues, particularly with the Central Energy Buyer where the existing European legal framework would limit what is possible.

The less interventionist Targeted Reforms or Enhanced Obligations package are conceptually easier to design but continue to leave key decisions about supply security to individual market participants, which may provide less confidence of achieving specified levels of supply security and carbon reduction... there are legal issues and complexities around the design and implementation of a minimum carbon price that could impact the timing and effectiveness of these packages...

More mandated outcomes could reduce the cost of finance (by reducing investor risk), reduce the risk of high prices resulting from under-investment, and remove some of the inefficiencies in current mechanisms such as the Renewables Obligation (RO). However, such approaches may expose customers to risks of overinvestment, and deprive them of some of the benefits of innovation and cost reductions driven by more effective competitive markets."

China's spectacular success with capacity addition, especially with super-critical technologies for thermal plants and solar and wind power plants, is a testament to the effectiveness of a virtual centralized market model. The enabling policy framework of equipment standardization, bulk manufacturing orders, clear and ambitious renewables targets, attractive subsidies for renewables undeprin their model. However, the Chinese experience also shows that this model has the potential to lead to over-investment and massively inefficient and incentive distorting subsidy handouts.

In contrast, the Indian model of targetted reforms with loosely binding renewables obligations, leaves decisions to the individual market participants and leaves many questions about supply security unanswered besides distorting price signals. The effectiveness of this model is questionable, especially when private sector may not have the resources and capability required to meet the massive target.

The biggest challenge for power sector in the days ahead will be that of arranging fuel supplies, one which the government is ideally suited to more effectively address or atleast facilitate. This becomes all the more important in view of the inevitability of sourcing fuels, both coal and gas, from external sources. This also means that it is imperative that the government strengthen the energy security dimension to its foreign policy. Further, the huge capacity addition requirements, manifested in the persistently high and under-estimated peak power deficit, means that there is very little possibility of inefficiency by way of idle capacity accumulating as a result of a centralized push.

Regarding renewables, the policy stance is less clear given the large tariff differentials. It becomes very difficult to incentivize private participants to invest in renewable sources without massive, and possibly unsustainable, tariff incentives, atleast for the foreseeable future.

In the coming days, I will be posting more on the requirements for a desirable market structure for India.

No comments:

Post a Comment