Complicating matters, forecasts from the CBO, the BLS, and the Social Security Administration (SSA) suggest that, absent cyclical movements, labor force participation will trace a downward course driven by the aging of the baby boom generation. Also worryingly, average job growth during the last economic expansion was just about 142,000 per month.

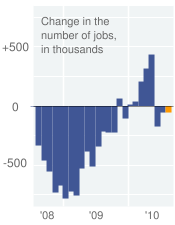

In this context, how have been the recent labor market trends? The last three months have witnessed net job losses.

Even the private sector job market shows no signs of buoyancy.

In the circumstances - prevailing job market environment, aging labor force, precedent of job creation during upturns, and the requirement to return close to normalcy - without additional external resources, the economy looks unlikely to return to normalcy any time for the foreseeable future. Do we need any more justification for another round of stimulus? Take the pick - high unemployment rates for the foreseeable future or short-term deficits?

No comments:

Post a Comment