In another speech, Deepak Mohanty, Executive Director at RBI, examined the nine incidents of double-digit inflation since 1954, and argued that "volatility as well as incidence and duration of double digit inflation has reduced over time". He points to the fact that despite the recent rise in food prices, inflation rates have been on a downward trend in India in recent decades.

That there is nothing simple about the causes of recent inflation is borne out by the near-uniform increases in inflation rates across all categories and on both supply and demand-sides. As the graphic below shows - now and in earlier instances of high inflation - both food and fuel prices (reflecting supply-side forces) and the prices of manufactured goods (reflecting demand-side ones) have been on the rise. This raises doubts on the utility of monetary policy alone in addressing these inflation episodes.

Historically too, periods of high inflation has coincided with demand and/or supply-side shocks, with food (mostly internal, monsoon failures etc) and fuel supply (mostly external) shocks being the most persistent. However, unlike demand-side ones, supply-side shocks are not amenable to being addressed with conventional monetary and even fiscal policy responses. This raises the need for automatic fiscal stabilizers and long-term efforts to improve farm productivity, besides more effective counter-cyclical macroeconomic management.

As is expected and can be seen from previous experiences, high inflation periods have coincided with increases in government borrowings. However, over the past few decades, inflation has remained relatively indifferent of the broad money growth rate. Dr Gokarn attributes this stability to the increased depth of Indian money markets which have been able to absorb the volumes and mitigated the potentially inflationary pressures.

Interestingly, inflation rates have been stable over the past two decades, with inflation volatility coming down sharply. Dr Gokarn also points to a "universal correlation between the level of the inflation rate and its stability" and the fact that the "reduction in the average inflation rate over the years has been accompanied by a sharp reduction in the volatility of that rate".

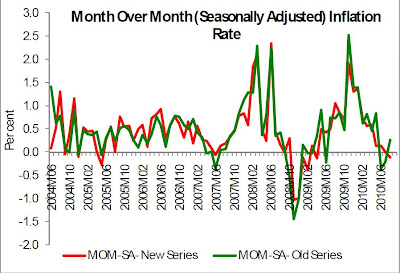

And he holds out hope about inflation prospects in the prevailing high inflation environment. The clearest indicator that the inflation is on its way down comes from the month-on-month rates of inflation which gives a sense about the momentum of inflation. Since early 2010, the momentum has clearly been on the negative.

No comments:

Post a Comment