The report points to the experience of Sweden and Finland with their respective debt deleveraging crises of 1990s, both of which involved two stages. In the first, households, corporations and financial institutions reduce their debt significantly over several years, while economic growth is negative or minimal and government debt rises. In the second phase, growth rebounds and government debt is reduced gradually over many years.

But for the US, South Korea, and Australia, all the ten major developed economies are in the initial stages of the debt deleveraging cycle.

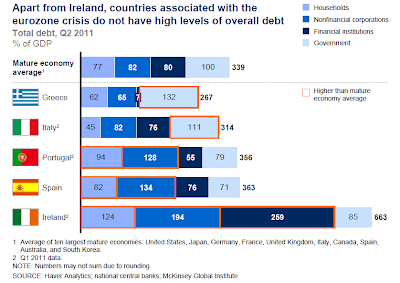

The composition of debt among households, non-financial corporations, financial institutions, and the government varies widely across these ten countries. The total debt of the Japan, driven by government borrowings, and United Kingdom, driven by loans taken by financial institutions, are of great concern.

Ironically, apart from Ireland, the debt positions of the other PIIGS economies does not look as frightening as those of UK and Japan. Only the Irish debt bears striking similarity with that of UK.

The report contrasts the successful recoveries of Sweden and Finland with the relative stagnation of Japan and identifies six critical markers of progress before the economic recovery takes off - the financial sector is stabilized and lending volumes are rising; structural reforms have been implemented; credible medium-term public deficit reduction plans are in place; exports are growing; private investment has resumed; and the housing market is stabilized, with residential construction reviving.

No comments:

Post a Comment